The remuneration structure of the Group’s CEO is established in order to align the incentives with the Group’s long-term interests, and in general, those of shareholders and investors, and to ensure the long-term sustainability of remuneration and incentive systems while taking into account changes in risks assumed by the Group over time.

The contract for the mandate 2021-2023, approved by the Board of Director of 25 February 2021 and reflected in the Remuneration policy approved by the Shareholders meeting of 29th April 2021, confirms the remuneration framework composed by fixed and variable components established so as to maximize the alignment with the interests of shareholders and the Company.

The remuneration package of the Group CEO is articulated in two components as follows:

- fixed remuneration paid for 40% on a monthly basis, in cash, and for 60% on a yearly basis (after the Shareholders’ meeting which approve the Financial Statements for the previous year). The payment of the 60% component, for 2/3 in cash and 1/3 in shares, is subject to the fact that no breach of contract with the Group’s customers has occurred that has led to a negative economic impact of more than 5% of Group EBITDA;

- variable remuneration, linked to the achievement of assigned objectives and paid entirely in shares over a deferred period of three years (from the payment of the up-front instalment). The Maximum amount is set at 200% of the maximum fixed remuneration for each year.

Variable Remuneration

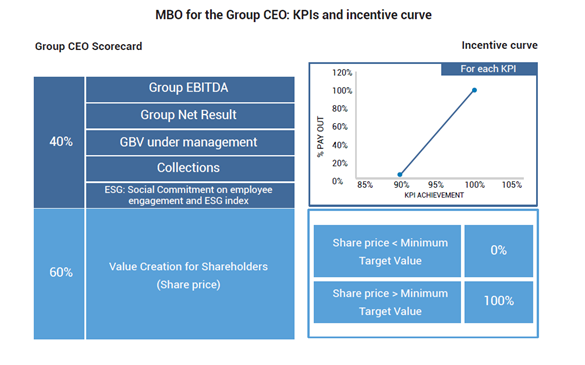

Payment of the variable remuneration is subordinate to the preliminary and joint achievement of the gates that also guarantee the sustainability of the Group’s incentive systems. Specifically, the annual variable compensation is not awarded to the Group CEO in the event that the following entry gates identified for the purposes of activating the CEO’s incentive system are not met in the specific year:

- Group EBITDA at least equal to the 80% of Group EBITDA defined in the annual plan (strategic and operational);

- DEBT to EBITDA ratio equal or lower than 3.

The above indicators will be considered net of extraordinary transactions (and related impacts) approved by the BoD during the reference year for the MBO.

For the purpose of awarding the 40% MBO it is required to achieve at least three of the performance indicators listed above, being the EBITDA required in any case.

The 60% is vested as a function of the creation of value for the shareholders, measured by the average share price comparison with a Target Value calculated by the Board of Directors for every period, with increasing values according to a formula which takes into account the amount of dividends distributed.

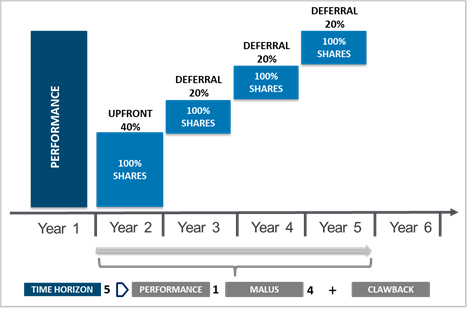

The variable remuneration of the Chief Executive Officer from both components, subject to the achieving of the assigned objectives and entry conditions, is paid fully in shares and as follows:

- for the 40% upfront,

- for the 60% deferred pro-quota in 3 years (20%, 20%, 20%).

The scheme is as follows:

Both up-front and deferred Shares may be sold for an amount that, on a quarterly base, may not exceed the 25% of awarded shares.

The payment of deferred amounts is also subject to the verification of malus conditions:

- 20% reduction, if the Group EBITDA is 25% less than the values ascertained at the end of the Accrual Year. If this reduction is higher than 50%, the deferred amounts will be reduced by 50%;

- 100% reduction (zeroing of the deferred amounts) if one of the clawback clauses included in the remuneration policy occurs during the deferral period.

Once the achievement of the above conditions has been verified, the payment of deferred amounts is also subject to meeting the condition that the average market value of shares in the 12 months prior to the Vesting Date is not lower to the Target Value of a percentage higher than 5% (Minimum Vesting Value). If on the vesting date, the Minimum Vesting Value has not been reached, vesting will be deferred by 12 months, after which, the condition will again be verified and, if again it has not been met, vesting will be deferred a further 12 months; if at this point (24 months after the original vesting date) the Minimum Vesting Value has not been reached, the corresponding deferred amount will be cancelled.